ArifMuzamil, ArifMuzamil (2016) FAKTOR-FAKTOR YANG MEMPENGARUHI RATING PENERBITAN OBLIGASI SYARIAH DAN DAMPAKNYA TERHADAP RETURN SAHAM (Studi Empiris Pada Perusahaan Non Keuangan yang Terdaftar di BEI tahun 2011-2014). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

Preview |

Text

COVER_1.pdf |

Preview |

Text

ABSTRAK_1.pdf |

Preview |

Text

DAFTAR ISI_1.pdf |

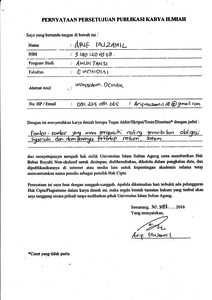

![PUBLIKASI.jpg [thumbnail of PUBLIKASI.jpg]](https://repository.unissula.ac.id/6342/4.hassmallThumbnailVersion/PUBLIKASI.jpg)  Preview |

Image

PUBLIKASI.jpg |

Preview |

Text

BAB I_1.pdf |

|

Text

BAB II_1.pdf Restricted to Registered users only |

|

|

Text

BAB III_1.pdf Restricted to Registered users only |

|

|

Text

BAB IV_1.pdf Restricted to Registered users only |

|

|

Text

BAB V_1.pdf Restricted to Registered users only |

|

Preview |

Text

DAFTAR PUSTAKA_1.pdf |

Abstract

The purpose of this study to examine and analyze on the effect of financial ratios (leverage

ratio, ratio, liquidity, profitabillitas ratio, solvency ratio ) against the bond rating and the impact on

stock returns in the non-financial companies listed on the Indonesian Stock Exchange period 20112014

.

`In determining the data to be examined sampling technique used was purposive sampling .

The sampling of 30 companies with data that is processed as many as 81. The analytical tool used in

this research is multiple linear regression .

The results of the partial test shows that leverage significant negative effect on the bond

rating , the liquidity ratio ( CUR ) negative effect significant bond rating , the profitability ratio ( ROA

) positive effect was not significant to the bond rating , the solvency ratio ( CTD ) positive and

significant impact the bond rating and bond rating no significant negative effect on stock returns .

While the simultaneous test shows that leverage , ( CUR ) , ( ROA ) , and ( CTD ) significantly affects

bond rating and bond rating no significant effect on stock returns .

Keywords: Financial ratios, Rating bonds, stocks Return.

| Dosen Pembimbing: | UNSPECIFIED | UNSPECIFIED |

|---|---|

| Item Type: | Thesis (Undergraduate) |

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi dan Bisnis Fakultas Ekonomi dan Bisnis > Mahasiswa FEB - Skripsi Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 30 Dec 2016 03:27 |

| Last Modified: | 30 Dec 2016 03:27 |

| URI: | https://repository.unissula.ac.id/id/eprint/6342 |

Actions (login required)

|

View Item |