Wulandari, Rica (2016) HARMONISASI PERJANJIAN MURABAHAH DENGAN AKTA JUAL BELI DALAM PEMBIAYAAN KEPEMILIKAN RUMAH PADA BANK SYARIAH (STUDI PADA PERJANJIAN MURABAHAH PADA BANK SYARIAH MANDIRI CABANG NGAWI). Masters thesis, Fakultas Hukum UNISSULA.

|

Text

COVER_1.pdf Download (947kB) | Preview |

|

|

Text

ABSTRAK_1.pdf Download (110kB) | Preview |

|

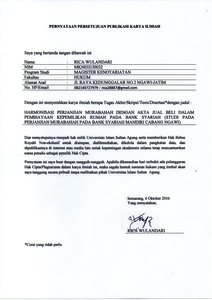

![[img]](http://repository.unissula.ac.id/6999/3.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

Image

PUBLIKASI.jpg Download (875kB) | Preview |

|

|

Text

DAFTAR ISI_1.pdf Download (696kB) | Preview |

|

|

Text

BAB I_1.pdf Download (346kB) | Preview |

|

|

Text

BAB II_1.pdf Restricted to Registered users only Download (450kB) |

||

|

Text

BAB III_1.pdf Restricted to Registered users only Download (757kB) |

||

|

Text

BAB IV_1.pdf Restricted to Registered users only Download (105kB) |

||

|

Text

DAFTAR PUSTAKA_1.pdf Download (262kB) | Preview |

Abstract

The process of financing of home ownership using the mechanism of buying and selling murabaha raises issues relating to the regulation of sale and purchase and registration of transfer of rights over land that has to do with the deed of sale before the land deed official with proof of ownership certificate of land and the house in accordance with Government Regulation No. 24 of 1997 on the Registration of land. The existence of the deed of sale murabaha made before a notary can not be relied upon by the customer (buyer) as evidence for transitional registration of land rights in the land agency office. Thesis writing is very important to provide information to the public about how the process of implementing murabaha financing home ownership in Islamic banks, analyzing contract-agreement in the process of financing home ownership with the agreement murabaha, in terms of Islamic law, sharia principles, positive law and the law relating to the registration and imposition of land rights, the constraints faced by the notary, PPAT and islamic banks in the agreement-making process of home ownership financing agreement. As for the issue to be examined in this study are: How is the implementation Harmonisasi PerjanjianMurabahah the Sale and Purchase Agreements in financing home ownership in Bank Syariah Mandiri branch Ngawi?, any constraints facing the implementation of the Harmonized of Murabaha agreement the Sale and Purchase Agreements in the financing of Bank Syariah Mandiri branch rumahpada Ngawi?, How to overcome obstacles implementation Murabahahdengan Harmonization Sale and Purchase Agreements in financing home ownership in Bank Syariah Mandiri branch Ngawi? The research is a qualitative study using empirical juridical approach. While Specifications research in this thesis in the form of research explanatory analysis. The technique of collecting data by using interview techniques. The results of this study indicate that: (1) The harmonization agreement murabaha financing home ownership is outwardly and formally fulfilling the requirements of an authentic act, which consists of the initial deed, deed bodies, and the final deed / cover. But materially, the deed has not a grain of truth material to fill in the deed, information or statements set forth, contained in the deed, or the statements of the parties given, delivered in deed murabaha is not correct, this is because the position of Bank Syariah Mandiri as sellers does not have a strong legal basis, there is no sufficient evidence to show that the Bank Syariah Mandiri is the owner of the land and the house. Practically customers buy a house directly on the developer, with a PPAT deed of sale in accordance with Government Regulation No. 24 of 1997 challenged the Land Registry. Thus murabahah home ownership is not yet fully apply Islamic principles in accordance with DSN No. 04 / DSN-MUI / IV / 2000 on the provision murabaha Islamic banking. (2) The obstacles encountered in the implementation of the Harmonization Agreement Murabahah with the Sale and Purchase Agreements in financing home ownership in Bank Syariah Mandiri Branch Ngawi between is that the making of the contract-contract related to the process of implementing murabaha financing home ownership has not shown an association and harmonization good between contract-contract and the other one primarily between the treaty murabaha with the deed of sale and APHT made before PPAT, no chapters that show the relationship between each other, so as if each deed stand alone without No legal relationship at all. More than that harmonization is done today only in terms of internal processes in the Bank Syariah Mandiri is the mechanism wakalah and proof of payment tranfers the home of Islamic banks to the developer through the customer's account, to meet and show that Bank Syariah Mandiri as the owner of the house. (3) How to overcome the constraints on the implementation of the Harmonized Murabahah with the Sale and Purchase Agreements in financing home ownership in Bank Syariah Mandiri branch Ngawi is to make changes and additions to the form, type and content in the process of implementing murabaha financing home ownership, in order to comply with Sharia principles and positive legal provisions, by way of sale and purchase under their hands first between Bank Syariah Mandiri with devoloper prior to the agreement murabaha, so that at the time made the agreement murabaha home ownership by Bank Syairah Mandiri was valid under Islamic Sharia law. Further harmonization efforts by creating a new type of contract clauses qardh and additional clause in the agreement and in the murabaha PPAT deed of sale, so that each of the deed of mutual harmony and the association between the covenants and other covenants.

| Item Type: | Thesis (Masters) |

|---|---|

| Subjects: | K Law > K Law (General) |

| Divisions: | Pascasarjana > Magister Kenotariatan |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 23 Jan 2017 02:07 |

| Last Modified: | 23 Jan 2017 02:07 |

| URI: | http://repository.unissula.ac.id/id/eprint/6999 |

Actions (login required)

|

View Item |