Agustia, Nira (2016) PENGARUH KOMITE AUDIT, KOMISARIS INDEPENDEN, STRUKTUR KEPEMILIKAN, DEBT COVENANT, DAN GROWTH OPPORTUNITIES TERHADAP KONSERVATISME AKUNTANSI (StudiEmpirisPadaPerusahaan Manufaktur di BEI Periode 2011 – 2014). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

COVER_1.pdf Download (797kB) | Preview |

|

|

Text

ABSTRAK_1.pdf Download (19kB) | Preview |

|

|

Text

BAB I_1.pdf Download (79kB) | Preview |

|

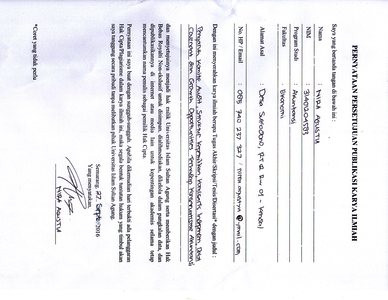

![[img]](http://repository.unissula.ac.id/6428/4.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

Image

PUBLIKASI.jpg Download (978kB) | Preview |

|

|

Text

DAFTAR ISI_1.pdf Download (68kB) | Preview |

|

|

Text

BAB I_1.pdf Download (79kB) | Preview |

|

|

Text

BAB II_1.pdf Restricted to Registered users only Download (124kB) |

||

|

Text

BAB III_1.pdf Restricted to Registered users only Download (100kB) |

||

|

Text

BAB IV_1.pdf Restricted to Registered users only Download (151kB) |

||

|

Text

BAB V_1.pdf Restricted to Registered users only Download (11kB) |

||

|

Text

DAFTAR PUSTAKA_1.pdf Download (61kB) | Preview |

Abstract

This study aims to test empirically the effect of audit committees, independent directors, ownership structure, debt covenants and the opportunity to grow to the level of accounting conservatism manufacturing company in Indonesia Stock Exchange. The research sample with criteria specified gained as much as 45 manufacturing companies that go public in Indonesia Stock Exchange for 4 years, so the data is processed as many as 180 data. Methods of data analysis using multiple linear regression. Processing results can be concluded that (1) there is no significant influence between the audit committee on accounting conservatism, (2) there was no effect statistically significant between independent directors to accounting conservatism, (3) there was no effect statistically significant between the ownership structure of the accounting conservatism , (4) no statistically significant influence and positive relationship between debt covenants to accounting conservatism, (5) there is a statistically significant influence and positive relationship between growth opportunities for accounting conservatism. The advice given is for potential investors in invested capital should be considered in company with debt covenants, and the high growth opportunities because it will affect the level of accounting conservatism. Keywords: audit committees, independent directors, ownership structure, debt covenants, the opportunity to grow and the level of accounting conservatism.

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 30 Dec 2016 06:46 |

| Last Modified: | 30 Dec 2016 06:46 |

| URI: | http://repository.unissula.ac.id/id/eprint/6428 |

Actions (login required)

|

View Item |