Rosyda, Lya Ulfa (2016) PENGARUH STRUKTUR KEPEMILIKAN DAN GOOD CORPORATE GOVERNANCE TERHADAP MANAJEMEN LABA. Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

COVER.pdf Download (721kB) | Preview |

|

|

Text

ABSTRAK.pdf Download (151kB) | Preview |

|

![[img]](http://repository.unissula.ac.id/6279/3.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

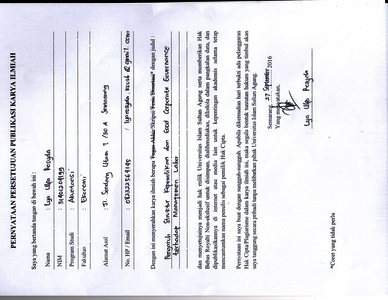

Image

PUBLIKASI.jpg Download (1MB) | Preview |

|

|

Text

DAFTAR ISI.pdf Download (203kB) | Preview |

|

|

Text

BAB I.pdf Restricted to Registered users only Download (181kB) |

||

|

Text

BAB II.pdf Restricted to Registered users only Download (338kB) |

||

|

Text

BAB III.pdf Restricted to Registered users only Download (370kB) |

||

|

Text

BAB IV.pdf Restricted to Registered users only Download (301kB) |

||

|

Text

BAB V.pdf Restricted to Registered users only Download (91kB) |

||

|

Text

DAFTAR PUSTAKA.pdf Download (236kB) | Preview |

Abstract

Earnings management arise because of the agency conflict, the separation between the ownership of the management company, the owner of the company authorizes the manager to take care of running of the company as managing funds and other corporate decisions on behalf of the owner. With the authority possessed by this, managers may not act in the best interest of the owner, because of different interests (conflict of interests). Flexibility in the management of the company may give rise to abuse of authority. Management as manager of the company will maximize the profits of companies which lead to the process of maximizing their interests at the expense of the owner of the company. This may occur because the manager has information that is not owned by the owner of the company. The purpose of this study was to determine the effect of managerial ownership, institutional ownership, independent board, the audit committee as well as leverage on earnings management. The population in this research is manufacturing companies listed in Indonesia Stock Exchange in the period 2010-2014, published in 2010-2014 IDX. Sampling using purposive sampling sampling on the basis of the characteristics and suitability of certain criteria, in order to get the samples in this study were 43 companies listed on the Indonesian Stock Exchange (BEI) in 2010-2014. Data analysis techniques used in this research is multiple linear regression analysis. The results showed that managerial ownership significant negative effect on earnings management and independent board significant negative effect on earnings management. Institutional ownership is not significant positive effect on earnings management while the audit committee significant negative effect on earnings management as well as variable dick leverage a significant negative effect on earnings management. Keywords: Managerial Ownership, Institutional Ownership, Independent Commissioner Board, the Audit Committee, Profit Management.

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 19 Dec 2016 08:01 |

| Last Modified: | 19 Dec 2016 08:01 |

| URI: | http://repository.unissula.ac.id/id/eprint/6279 |

Actions (login required)

|

View Item |