Hilyana, Elya Hilyana (2018) PENGARUH STRUKTUR MODAL DAN MARKET TO BOOK VALUE TERHADAP KINERJA KEUANGAN PERUSAHAAN (Pada Perusahaan Manufaktur yang terdaftar di Bursa Efek Indonesia). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

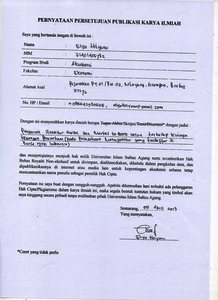

![[img]](http://repository.unissula.ac.id/11074/1.hassmallThumbnailVersion/publikasi.jpg)

|

Image

publikasi.jpg Download (1MB) | Preview |

|

|

Text

01. Halaman Sampul.pdf Download (21kB) | Preview |

|

|

Text

08. Abstrak.pdf Download (7kB) | Preview |

|

|

Text

09. Daftar Isi.pdf Download (25kB) | Preview |

|

|

Text

13. BAB I Pendahuluan.pdf Download (81kB) | Preview |

|

|

Text

14. BAB II Kajian Teori.pdf Restricted to Registered users only Download (219kB) |

||

|

Text

15. BAB III Metode Penelitian.pdf Restricted to Registered users only Download (225kB) |

||

|

Text

16. BAB IV Pembahasan.pdf Restricted to Registered users only Download (264kB) |

||

|

Text

17. BAB V Penutup.pdf Restricted to Registered users only Download (326kB) |

||

|

Text

18. Daftar Pusataka.pdf Download (20kB) | Preview |

Abstract

This study aims to analyze the influence of capital structure and market to book value on the company's financial performance (in manufacturing companies listed on the Indonesia Stock Exchange). Dependent variable in this research is company's financial performance measured by Return on equity (ROE), independent variable in this research is capital structure measured with Debt to Equity Ratio (DER) and Stock Market Price measured by Market to Book Value (MTBV). The population in this study includes all manufacturing companies listed in Indonesia Stock Exchange period 2014 - 2016. The method used to determine the sample research is purposive sampling method, so that obtained 59 sample companies from 143 companies listed on the Indonesia Stock Exchange. The analytical method used in this research is Best Linear Unbiased Estimation (BLUE). The results of this study indicate that the capital structure variable (DER) has a negative and significant effect on financial performance (ROE). And the stock market price (MTBV) has a significant positive effect on financial performance (ROE). Keywords: Company's financial performance (Return On Equity), Capital Structure (Debt to equity ratio), Market to book value

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 05 Oct 2018 04:01 |

| Last Modified: | 05 Oct 2018 04:01 |

| URI: | http://repository.unissula.ac.id/id/eprint/11074 |

Actions (login required)

|

View Item |