Shohafi, Muhammad (2017) PENGARUH STRUKTUR KEPEMILIKAN SAHAM, STRUKTUR MODAL, PROFITABILITAS, CSR DAN KEBIJAKAN DEVIDEN TERHADAP NILAI PERUSAHAAN. Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

1. COVER.pdf Download (883kB) | Preview |

|

|

Text

2. DAFTAR ISI.pdf Download (83kB) | Preview |

|

![[img]](http://repository.unissula.ac.id/9092/3.hassmallThumbnailVersion/Pernyataan%20Publikasi.jpg)

|

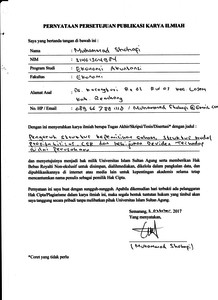

Image

Pernyataan Publikasi.jpg Download (926kB) | Preview |

|

|

Text

3. ABSTRAK.pdf Download (87kB) | Preview |

|

|

Text

4. BAB I.pdf Download (127kB) | Preview |

|

|

Text

5. BAB II.pdf Restricted to Registered users only Download (163kB) |

||

|

Text

6. BAB III.pdf Restricted to Registered users only Download (308kB) |

||

|

Text

7. BAB IV.pdf Restricted to Registered users only Download (220kB) |

||

|

Text

8. BAB V.pdf Restricted to Registered users only Download (97kB) |

||

|

Text

9. DAFTAR PUSTAKA.pdf Download (96kB) | Preview |

Abstract

Each company has a defined goal, both short-term and long-term goals. With regard to long-term goals, companies that have gone public will always strive to maximize the value of the company. Therefore, to increase the value of the company is the structure of share ownership, capital structure, profitability, dividend policy, CSR. The population in this study are all manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2013-2015 and sampling techniques using purposive sampling method with the number of samples of 144 manufacturing companies listed on the Stock Exchange. The data used are secondary data obtained from the Capital Market Information Center - IDX Investor Club Semarang which is located at Jalan MH Thamrin No.152 Semarang, Indonesia Capital Market Directory (ICMD) and Company Report (CR) obtained from the website of Indonesia Stock Exchange (IDX) BEI) www.idx.co.id. This research method uses multiple linier regression analysis method to test hypothesis. The result of hypothesis testing shows that institutional ownership positively affects company value, managerial ownership positively affects firm value, capital structure negatively affects firm value, profitability has positive effect to firm value, CSR has positive effect to firm value, dividend policy has positive effect to firm value . Keywords: Share ownership structure, capital structure, profitability, dividend policy and CSR

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 05 Jan 2018 01:51 |

| Last Modified: | 05 Jan 2018 01:51 |

| URI: | http://repository.unissula.ac.id/id/eprint/9092 |

Actions (login required)

|

View Item |