Almiftah, Abi Raud (2016) Analisis Pengaruh Kinerja Keuangan terhadap Return Saham (Studi Pada Saham Indeks LQ45 Periode 2011-2014 Yang Terdaftar Pada Bursa Efek Indonesia). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

COVER_1.pdf Download (735kB) | Preview |

|

|

Text

ABSTRAK_1.pdf Download (94kB) | Preview |

|

|

Text

DAFTAR ISI_1.pdf Download (244kB) | Preview |

|

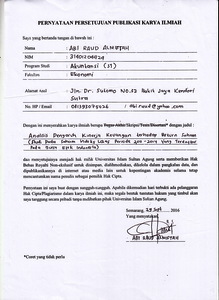

![[img]](http://repository.unissula.ac.id/6389/4.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

Image

PUBLIKASI.jpg Download (2MB) | Preview |

|

|

Text

BAB I_1.pdf Download (167kB) | Preview |

|

|

Text

BAB II_1.pdf Restricted to Registered users only Download (348kB) |

||

|

Text

BAB III_1.pdf Restricted to Registered users only Download (384kB) |

||

|

Text

BAB IV_1.pdf Restricted to Registered users only Download (344kB) |

||

|

Text

BAB V_1.pdf Restricted to Registered users only Download (94kB) |

||

|

Text

DAFTAR PUSTAKA_1.pdf Download (95kB) | Preview |

Abstract

The company's performance is something that is very important, because it affects the company's performance and can be used as a tool to determine whether the company has developed or otherwise. The company's performance is also a benchmark for investors in investing. This study aimed to analyze the effect of the financial performance of the stock return on stocks LQ45 2011-2014 listed on the Indonesia Stock Exchange. Financial performance in this study is represented by the ratio consisting of Current Ratio (CR), Debt to Equity Ratio (DER), Return on Equity (ROE), and Price Earning Ratio (PER). The population in this study is LQ45 companies listed on the Indonesia Stock Exchange, with a purposive sampling technique obtained 76 observations. The data in this study were obtained from the annual financial statements and analyzed using multiple linear regression analysis with significance level of 5%. The results showed that the variable DER significant negative effect on Stock Return; these variables have a different direction with the proposed hypothesis. Variable CR, ROE, and PER in the same direction with the proposed hypothesis, namely; CR significant positive effect on Stock Return, ROE significant positive effect on Stock Return, and PER significant positive effect on Stock Return. The predictive ability of the four independent variables to Return Stocks in this study amounted to 50.40% while the remaining 49.60% influenced by other factors not included in the model study. The result is expected that the variable Current Ratio (CR), Debt to Equity Ratio (DER), Return on Equity (ROE), and Price Earning Ratio (PER) can be used as a reference, either by the management company in the management of companies and investors in determining investment strategy. Keyword: Current Ratio (CR), Debt to Equity Ratio (DER), Return On Equity (ROE), Price Earning Ratio (PER), Stock Return

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 30 Dec 2016 04:27 |

| Last Modified: | 30 Dec 2016 04:27 |

| URI: | http://repository.unissula.ac.id/id/eprint/6389 |

Actions (login required)

|

View Item |