Atmaja, Dimas Arya Dwi (2016) PENGARUH TATA KELOLA PERUSAHAAN DAN KEPEMILIKAN KELUARGA TERHADAP PENGHINDARAN PAJAK (studi pada perusahaan manufaktur yang terdaftar di BEI tahun 2011-2013). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

COVER_1.pdf Download (845kB) | Preview |

|

|

Text

ABSTRAK_1.pdf Download (121kB) | Preview |

|

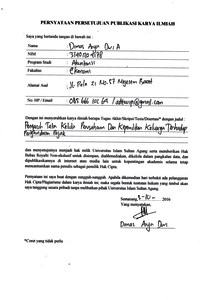

![[img]](http://repository.unissula.ac.id/6272/3.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

Image

PUBLIKASI.jpg Download (752kB) | Preview |

|

|

Text

DAFTAR IIS_1.pdf Download (133kB) | Preview |

|

|

Text

BAB I_1.pdf Restricted to Registered users only Download (323kB) |

||

|

Text

BAB II_1.pdf Restricted to Registered users only Download (290kB) |

||

|

Text

BAB III_1.pdf Restricted to Registered users only Download (577kB) |

||

|

Text

BAB IV_1.pdf Restricted to Registered users only Download (205kB) |

||

|

Text

BAB V_1.pdf Restricted to Registered users only Download (126kB) |

||

|

Text

DAFTAR PUSTAKA_1.pdf Download (121kB) | Preview |

Abstract

This study aims to find empirical evidence about the influence of the Corporate Governance and Ownership Families Against Tax Avoidance. The samples in this study using purposive sampling method. And secondary data used descriptive method. The sample in this study consisted of 50 manufacturing companies. Data analysis technique used is ordinary least squares (OLS) Based on these studies show that (1) the background of the audit committee expertise positive effect on tax evasion, where it has significant value in the t test amounted to 0.047 <0.05 (2) independent board has no effect on tax evasion, this is indicated by significant value in the t test amounted to 0.185> 0.05 (3) executive compensation positive effect on tax evasion, where it has significant value in the t test of 0.009 <0.05 (4) public ownership has no effect on tax evasion, it is shown by the significant value on the t test of 0.302> 0.05 (5) the share ownership positively affects tax evasion, where it has significant value in the t test amounted to 0.011 <0.05 (6) of family ownership has no effect on tax evasion , where it has significant value in the t test amounted to 0.078> 0.05. Keywords: Background Skills Audit Committee, Proportion of Independent Commissioners, Executive Compensation, Public Ownership Structure, Structure Largest Shareholders, Owners Family, Tax Avoidance.

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HF Commerce > HF5601 Accounting |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 19 Dec 2016 08:01 |

| Last Modified: | 19 Dec 2016 08:01 |

| URI: | http://repository.unissula.ac.id/id/eprint/6272 |

Actions (login required)

|

View Item |