Lusiana, Savita (2018) PENGARUH FAKTOR MAKRO EKONOMI TERHADAP RETURN SAHAM DAN IHSS SEBAGAI VARIABEL PEMODERASI (Pada perusahaan sektor Properti dan Real Estate di BEI). Undergraduate thesis, Fakultas Ekonomi UNISSULA.

|

Text

COVER_1.pdf Download (770kB) | Preview |

|

|

Text

ABSTRAK_1.pdf Download (137kB) | Preview |

|

|

Text

DAFTAR ISI_1.pdf Download (149kB) | Preview |

|

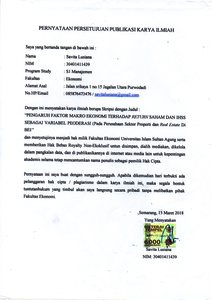

![[img]](http://repository.unissula.ac.id/11304/4.hassmallThumbnailVersion/PUBLIKASI.jpg)

|

Image

PUBLIKASI.jpg Download (810kB) | Preview |

|

|

Text

BAB I_1.pdf Download (183kB) | Preview |

|

|

Text

BAB II_1.pdf Restricted to Registered users only Download (226kB) |

||

|

Text

BAB III_1.pdf Restricted to Registered users only Download (201kB) |

||

|

Text

BAB IV_1.pdf Restricted to Registered users only Download (911kB) |

||

|

Text

BAB V_1.pdf Restricted to Registered users only Download (187kB) |

||

|

Text

DAFTAR PUSTAKA_1.pdf Download (128kB) | Preview |

Abstract

The purpose of this study was to examine the influence of inflation, interest rates, and exchange rates against a Return of shares as well as the IHSS as variable moderation. This research was taken because there is still a difference between a research study with one another and there is a difference between the real state of existing research data. The variables used in this study is the dependent variable as a Stock Return, as well as inflation, interest rates, exchange rate as independent variable, and the variable pemoderasi as an IHSS. Methods of analysis used was multiple linear regression analysis previously done a classic assumption test, including the test of normality, multikolinieritas test, heteroskedastisitas test, and a test of autocorrelation. And then the last test using t test, and R2. The results of the regression analysis, it can be noted that Inflation and interest rates significantly to negative effect of stock Return. The positive effect of the exchange rate significantly to Return the shares. While the moderate variable test results note that IHSS is not as variable moderator the influence of Inflation against the Return of shares. IHSS as moderator variables influence the interest rate against the Return of shares. IHSS is not as moderator variables influence the exchange rate against the Return of shares. The ability of prediction of a third variable against the Return of shares in this study of 47.10% 52.90% while the rest is influenced by other factors not included in the research model. Key word :Return of stocks, inflation, interest rates, exchange rates and IHSS.

| Item Type: | Thesis (Undergraduate) |

|---|---|

| Subjects: | H Social Sciences > HD Industries. Land use. Labor > HD28 Management. Industrial Management |

| Divisions: | Fakultas Ekonomi Fakultas Ekonomi > Akuntansi |

| Depositing User: | Pustakawan 1 UNISSULA |

| Date Deposited: | 05 Oct 2018 04:45 |

| Last Modified: | 05 Oct 2018 04:45 |

| URI: | http://repository.unissula.ac.id/id/eprint/11304 |

Actions (login required)

|

View Item |